All You Need to Know About the India-Middle East-Europe Economic Corridor ( (IMEEEC))

The India-Middle East-Europe Economic Corridor (IMEEEC) is a significant trade and infrastructure initiative that seeks to connect the Indian subcontinent, the Middle East, and Europe through a network of roads, railways, ports, and trade routes. This corridor holds immense potential for trade, economic growth, and regional cooperation. Here's what you need to know about this ambitious project:

At the September G20 summit, host nation India, in conjunction with the United States, the European Union, France, Germany, Italy, Saudi Arabia, and the United Arab Emirates (UAE), inked a memorandum of understanding. This non-binding agreement commits them to collaborate on constructing two distinct "corridors." These corridors essentially represent a political framework linked by a combination of both new and pre-existing physical infrastructure.

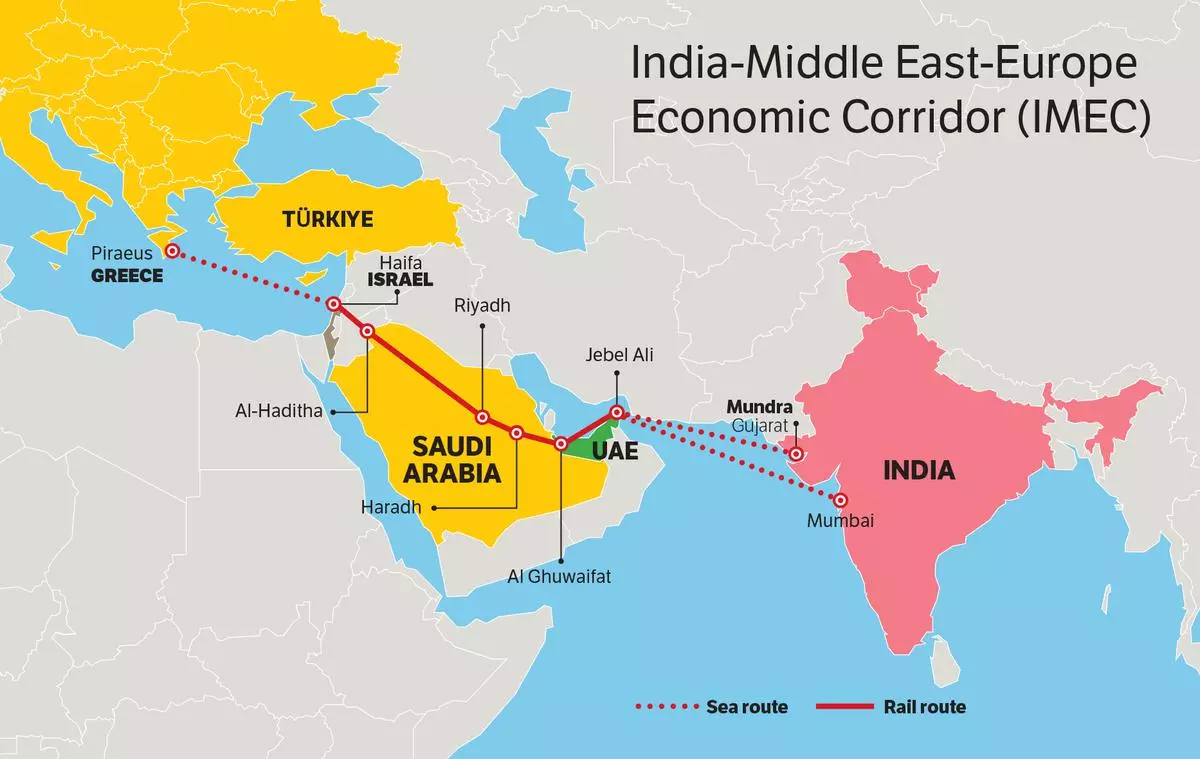

The eastern corridor's vision is to establish a connection between India and the Arabian Gulf, while the northern corridor seeks to link the Arabian Gulf with Europe. One of the most prominent infrastructure projects within this initiative is a traditional railway.

This project constitutes a ship-to-rail transit network designed to facilitate the transportation of goods and services to, from, and between India, the UAE, Saudi Arabia, Jordan, Israel, and Europe. Equally significant is the inclusion of other components along the railway line, such as the installation of electrical and digital connectivity cables and, most crucially, a conduit for exporting clean hydrogen from the Gulf to Europe.

The primary objective was for the United States and the European Union to showcase their capacity for generating ideas related to connectivity. A less generous interpretation suggests an attempt to rival China's Belt and Road Initiative.

For the United States, this marks a somewhat belated foray into the realm of infrastructure for development and the expansion of diplomatic influence. Some of the states involved in these corridors are already well-advanced in their economic integration objectives.

The European Union, on the other hand, prioritizes de-risking in its relations with China, but energy security takes precedence. For Europe, the prospect of securing transportation and establishing the infrastructure to create a market for green hydrogen outweighs the demonstration of a regional economic development agenda.

The challenge for the US and the EU lies in their lack of government institutions capable of financing this corridor in the manner that China has traditionally relied on its local banking sector to extend its infrastructure and connectivity into emerging markets.

The IMEC is part of a larger collaboration involving G7 governments, international financial institutions, and primarily US-based infrastructure investors. In response to China's Belt and Road Initiative, the US government and G7 partners unveiled a Partnership for Global Infrastructure and Investment (PGII) in May 2023.

The aim is to provide political support for blended finance in clean power, transport, healthcare, and climate-resilient infrastructure in low and middle-income countries. These countries typically depend on higher-interest loans from private banks and concessional finance from entities like the World Bank or International Finance Corporation for large-scale projects.

China's BRI contributed financing and contracting firms to execute such projects. The private sector approach to multilateral finance signifies a political commitment to steer available funds within existing development banks and agencies, working in concert with private investors, while also providing some risk guarantees in cases of default or currency depreciation.

While innovative and necessary, this policy work doesn't result in the immediate construction of power plants or major infrastructure. The regulatory obstacles and issues related to local governance complicate the execution of such projects in many low and middle-income nations.

The projects announced under the PGII should be viewed as potential test cases, each facing distinct challenges and choices within its domestic political economy. The IMEC doesn't fit neatly into the PGII initiatives because it doesn't accelerate clean energy finance, and the countries it links aren't all low or middle-income.

Nonetheless, the IMEC aligns with broader energy security objectives for European nations and allows the United States to advance its national security goal by fostering regional economic integration, particularly by linking its strategic partners, Israel and Saudi Arabia, via rail.

The IMEC corridor embodies a Western vision of achieving balance in a multipolar system, essentially adding states to its side of the ledger for potential future conflicts, particularly with China. In reality, the IMEC corridor offers benefits to all parties, including China. The Gulf, with the UAE at the forefront, already serves as a crucial re-export hub for Chinese goods. An additional land corridor would only enhance this existing capacity via Jebel Ali.

1. The Vision: IMEEEC aims to establish efficient connectivity and trade links between India, the Middle East, and Europe. This initiative envisions fostering economic cooperation, enhancing transportation networks, and facilitating the movement of goods and people across these regions.

2. Geographical Coverage: The corridor covers a vast expanse, spanning from India's west coast to Europe, passing through the Middle East. It encompasses countries like India, the United Arab Emirates, Iran, Oman, Saudi Arabia, Jordan, Turkey, and several European nations.

3. Key Components: The IMEEEC comprises multiple components, including road networks, railways, shipping routes, and logistics hubs. It also involves the development of special economic zones, industrial clusters, and infrastructure facilities along the route.

4. Trade Benefits: The corridor is expected to boost trade and economic activities by providing a shorter and more cost-effective route for transporting goods between India, the Middle East, and Europe. This will reduce transit times and logistics costs, making the movement of goods more efficient.

5. Economic Growth: IMEEEC has the potential to drive economic growth and development in the participating countries. It can create job opportunities, promote industrialization, and attract foreign investments along the corridor.

6. Challenges: Implementing such a vast and intricate project comes with its challenges. These include securing investments, addressing geopolitical concerns, and overcoming logistical and administrative hurdles.

7. Geopolitical Significance: The corridor holds geopolitical importance by strengthening economic and political ties between the regions involved. It can also influence regional dynamics and cooperation.

8. International Cooperation: IMEEEC requires collaboration and cooperation between governments, international organizations, and the private sector. It is a testament to the global nature of modern infrastructure and trade projects.

9. Environmental Impact: The project should consider its environmental impact and sustainability. Sustainable practices and eco-friendly infrastructure should be integrated into the corridor's development.

10. Future Prospects: While IMEEEC is still in the planning and development stages, it has the potential to reshape the economic landscape of the involved regions. Its success will depend on effective implementation, investment, and overcoming various challenges.

Modes of connectivity

A substantial portion of the concepts related to increased connectivity had been under consideration for several years before the announcement of the IMEC, and the impetus for these ideas primarily originated in the Gulf region rather than from the United States or Europe.

The prevailing theme in the Gulf region revolves around interconnection rather than polarity, reflecting the core principles of current national visions and strategic priorities. This approach has rekindled previous endeavors aimed at enhancing integration within the Gulf Cooperation Council (GCC), including the development of the GCC rail network.

For the Gulf states, points of connection, whether through rail, air, or sea routes, hold paramount importance in their diversification agendas. These connections are particularly crucial for their capacity to export a diverse range of energy products, spanning from renewables to hydrocarbons, as well as emerging industries like mining. Additionally, they play a pivotal role in ensuring a reliable supply of imported food.

Connectivity, in this context, takes on a multifaceted character encompassing geographical, multi-modal, and political dimensions. None of the Gulf states desire to take sides in any potential Western disputes with China. Instead, their primary objective is to secure free-trade agreements and comprehensive economic partnerships, emphasizing the significance of these initiatives as national security priorities. These agreements are pivotal for connecting to established economic centers and hubs, strengthening their economic resilience and sustainability.

The primary focus of priorities in the Gulf region is directed more toward establishing connections with Asian nations, including South Korea, Japan, and Indonesia, rather than prioritizing relationships with countries within the Middle East and North Africa (MENA) region. Additionally, considerations related to supply chain logistics for renewable energy products, such as minerals like copper, cobalt, and phosphate for fertilizer, are driving the Gulf's interest in acquiring assets in Latin America and Africa.

Food security plays a pivotal role in numerous India-UAE partnership agreements, including the I2U2 (India-US-Israel-UAE) quad.

The GCC rail project has been a subject of discussion for over a decade. It was initially approved at the 30th GCC summit in Kuwait City in December 2009, with a projected completion date set for 2018. However, the sharp decline in oil prices in 2016 marked the project's first delay in terms of project awards.

Moreover, the GCC dispute, which lasted formally from June 2017 to January 2021, involving the UAE, Saudi Arabia, Bahrain, and Egypt with their neighbor Qatar, disrupted all prospects of regional economic integration. It was only with the AlUla agreement in January 2021 that the GCC secretariat effectively recommenced the project, even though the six member states are currently in different stages of new tenders and awards.

In January 2022, GCC leaders approved the establishment of the GCC Rail Authority. During the same year, Oman and the UAE founded the Oman-Etihad Rail Company to implement a 303-kilometer network, with support from the Emirati state-owned fund Mubadala Investment. This rail network isn't primarily intended for passenger transport or consumer goods but rather focuses on energy and logistics supply chains.

The Oman-Etihad Rail Company signed a memorandum of understanding (MoU) with the Brazilian mining company Vale to explore the utilization of rail transport for iron ore and its derivatives between Oman and the UAE. This connection links Vale's industrial complex in Oman's Sohar Port and Freezone with a planned hub in Abu Dhabi.

Vale is the same company in which the Saudi Public Investment Fund (PIF) and the state mining company Maaden recently acquired a 10% stake. Oman and Saudi Arabia have plans to establish a railway link connecting Duqm with Riyadh through the Ibri border, creating a planned economic zone in the Al-Dhahirah area. Despite the revival of the GCC rail network plan, Oman isn't a signatory to the IMEC memorandum of understanding. Its new port development on the Arabian Sea at Duqm, which is much closer to India, is not part of the corridor.

Mining is a central component of Saudi Vision 2030, representing the "third pillar" of the diversification strategy. While significant attention is often directed at financial investments in sports and entertainment, the government's substantial commitment is in the field of mining and giga-projects, with an expected investment of approximately $850 billion.

Mining is poised to become the largest industry after oil and gas, with the potential to employ a quarter of a million people and a target to contribute $75 billion to Saudi GDP by 2030. The plan encompasses domestic mining, refining operations, and processing, which could ultimately support local manufacturing. This development may not directly challenge China in battery manufacturing but can potentially secure some market share.

In the context of European and American efforts to reduce risks, this capacity and delivery network represent attractive investments, even if they are on a smaller scale compared to China's mining and mineral processing endeavors. However, within IMEC, it remains unclear how the existing rail network in Saudi Arabia will link to new giga-projects and mining initiatives and determine the most efficient points for processing and potential exports.

A joint hydrogen task force has also been established to help scale up technologies, with a special focus on producing green hydrogen. The UAE is India's third-largest trade partner, with their bilateral trade projected to raise the value of bilateral trade to $100bn by 2027. The India-UAE Cepa was India's first bilateral trade agreement in the MENA region.

Across the MENA region, including in the UAE, Oman, Egypt, Morocco and Mauritania, there are several green hydrogen production plans and MOUs. Securing long-term off-take agreements for the purchase of the product has proved difficult.

However, MEES reports that in Saudi Arabia, the production of green ammonia from green hydrogen at NEOM (in a joint venture between Air Products as the off-taker and ACWA power) has been possible because of good access to local bank loans and strong government backing.

At the same time, the global investor market for green hydrogen is also shifting because of new American industrial policy and tax incentives as part of the Inflation Reduction Act, which may mean that, in a decade, the competition between US and MENA producers for export markets in Europe could intensify (or that production facilities in the US are built before others can align financing and purchase agreements.)

- Web Development

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness