The farm management software market size was valued at USD 4.16 billion in 2024. It is projected to grow from USD 4.87 billion in 2025 to USD 20.28 billion by 2034, exhibiting a CAGR of 17.2% during 2025–2034.

Farm management software (FMS) enables farmers to optimize operations by collecting, processing, and analyzing data related to crop cycles, field activities, livestock, finances, weather, and input usage. The rising need for precision agriculture, sustainable farming, labor cost reduction, and yield maximization is fueling the adoption of these systems.

The integration of emerging technologies such as agricultural drones, IoT sensors, satellite imagery, and AI-driven analytics is further enhancing software functionality. Governments and agritech companies alike are investing heavily in digital infrastructure to support farmers in both developed and emerging markets.

Market Segmentation

The Farm Management Software Market is segmented based on component, deployment model, application, farm size, and region, offering insights into the dynamic demands of global agricultural practices.

1. By Component:

• Software

o Web-based

o Cloud-based

o On-premise

• Services

o Managed Services

o Professional Services (Consulting, Integration, Training)

The cloud-based software segment dominates due to its scalability, accessibility, and real-time data syncing capabilities. As internet connectivity improves in rural areas, this segment is expected to witness the fastest growth.

2. By Deployment Model:

• On-Premise

• Cloud-Based

Cloud deployment leads the market, offering flexibility, lower upfront costs, and ease of maintenance. On-premise solutions remain popular with large farms needing higher data security and control.

3. By Application:

• Precision Farming

• Crop Monitoring

• Livestock Management

• Irrigation Management

• Inventory & Equipment Management

• Financial Management

• Weather Forecasting & Analytics

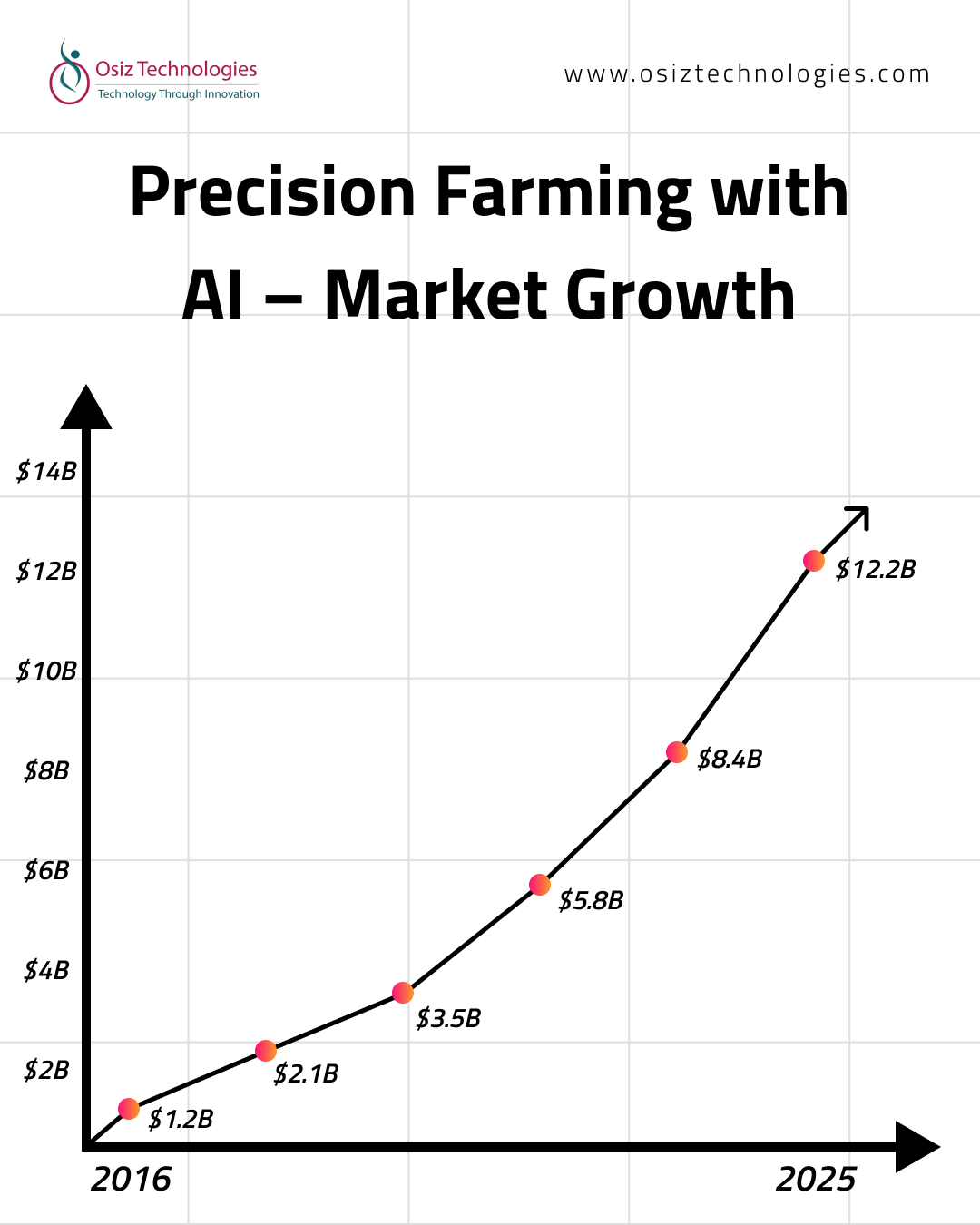

Precision farming holds the largest market share, followed by crop monitoring and livestock management, due to the growing need for accurate, data-driven decisions that optimize input use and yield.

4. By Farm Size:

• Small Farms

• Medium Farms

• Large Farms

While large farms are early adopters of advanced software systems, the increasing affordability and availability of digital solutions are pushing small and medium-sized farms to embrace technology.

Regional Analysis

The global Farm Management Software Market exhibits significant growth across all major regions, with North America and Asia-Pacific emerging as dominant players.

1. North America:

North America remains a front-runner in adopting farm management software due to widespread awareness, strong infrastructure, and early investment in precision agriculture. The United States and Canada are investing heavily in sustainable practices, encouraging farmers to adopt digital systems to comply with environmental standards and optimize resource use.

2. Europe:

European countries, led by Germany, France, and the Netherlands, are advancing rapidly toward sustainable farming and organic agriculture. Governmental programs under the EU’s Common Agricultural Policy (CAP) support digital transformation through funding and training initiatives. This has contributed to the accelerated adoption of crop monitoring and decision-support systems.

3. Asia-Pacific:

The Asia-Pacific region is projected to witness the highest CAGR during the forecast period. Countries like India, China, Japan, and Australia are investing in smart farming technologies to address food security concerns and climate change impacts. The region’s large population of smallholder farmers is increasingly turning to mobile-based solutions for affordable and effective farm management.

4. Latin America:

Brazil and Argentina are leading the charge in precision agriculture adoption, primarily in soybean, corn, and sugarcane cultivation. The region shows growing interest in agricultural drones and satellite analytics for large plantations and export-oriented farming.

5. Middle East and Africa (MEA):

While still in the nascent stages, the MEA region is beginning to implement smart farming solutions to improve irrigation efficiency and combat arid climate challenges. Government-backed initiatives in countries like Israel, South Africa, and the UAE are fostering innovation and adoption of digital farming tools.

Read More @

https://www.polarismarketresearch.com/industry-analysis/farm-management-software-market

The farm management software market size was valued at USD 4.16 billion in 2024. It is projected to grow from USD 4.87 billion in 2025 to USD 20.28 billion by 2034, exhibiting a CAGR of 17.2% during 2025–2034.

Farm management software (FMS) enables farmers to optimize operations by collecting, processing, and analyzing data related to crop cycles, field activities, livestock, finances, weather, and input usage. The rising need for precision agriculture, sustainable farming, labor cost reduction, and yield maximization is fueling the adoption of these systems.

The integration of emerging technologies such as agricultural drones, IoT sensors, satellite imagery, and AI-driven analytics is further enhancing software functionality. Governments and agritech companies alike are investing heavily in digital infrastructure to support farmers in both developed and emerging markets.

Market Segmentation

The Farm Management Software Market is segmented based on component, deployment model, application, farm size, and region, offering insights into the dynamic demands of global agricultural practices.

1. By Component:

• Software

o Web-based

o Cloud-based

o On-premise

• Services

o Managed Services

o Professional Services (Consulting, Integration, Training)

The cloud-based software segment dominates due to its scalability, accessibility, and real-time data syncing capabilities. As internet connectivity improves in rural areas, this segment is expected to witness the fastest growth.

2. By Deployment Model:

• On-Premise

• Cloud-Based

Cloud deployment leads the market, offering flexibility, lower upfront costs, and ease of maintenance. On-premise solutions remain popular with large farms needing higher data security and control.

3. By Application:

• Precision Farming

• Crop Monitoring

• Livestock Management

• Irrigation Management

• Inventory & Equipment Management

• Financial Management

• Weather Forecasting & Analytics

Precision farming holds the largest market share, followed by crop monitoring and livestock management, due to the growing need for accurate, data-driven decisions that optimize input use and yield.

4. By Farm Size:

• Small Farms

• Medium Farms

• Large Farms

While large farms are early adopters of advanced software systems, the increasing affordability and availability of digital solutions are pushing small and medium-sized farms to embrace technology.

Regional Analysis

The global Farm Management Software Market exhibits significant growth across all major regions, with North America and Asia-Pacific emerging as dominant players.

1. North America:

North America remains a front-runner in adopting farm management software due to widespread awareness, strong infrastructure, and early investment in precision agriculture. The United States and Canada are investing heavily in sustainable practices, encouraging farmers to adopt digital systems to comply with environmental standards and optimize resource use.

2. Europe:

European countries, led by Germany, France, and the Netherlands, are advancing rapidly toward sustainable farming and organic agriculture. Governmental programs under the EU’s Common Agricultural Policy (CAP) support digital transformation through funding and training initiatives. This has contributed to the accelerated adoption of crop monitoring and decision-support systems.

3. Asia-Pacific:

The Asia-Pacific region is projected to witness the highest CAGR during the forecast period. Countries like India, China, Japan, and Australia are investing in smart farming technologies to address food security concerns and climate change impacts. The region’s large population of smallholder farmers is increasingly turning to mobile-based solutions for affordable and effective farm management.

4. Latin America:

Brazil and Argentina are leading the charge in precision agriculture adoption, primarily in soybean, corn, and sugarcane cultivation. The region shows growing interest in agricultural drones and satellite analytics for large plantations and export-oriented farming.

5. Middle East and Africa (MEA):

While still in the nascent stages, the MEA region is beginning to implement smart farming solutions to improve irrigation efficiency and combat arid climate challenges. Government-backed initiatives in countries like Israel, South Africa, and the UAE are fostering innovation and adoption of digital farming tools.

Read More @ https://www.polarismarketresearch.com/industry-analysis/farm-management-software-market